Office properties: trends and challenges

Office property is the most common asset class in commercial real estate. Usually, the market development of office properties indicates the general development of an economy. Consequently, office properties also play an important role at EXPO REAL. The office property trade fair brings together all relevant players from commercial real estate segment —from planners and project developers to financiers and investors, from consultants and brokers to facility managers and potential users. Also, the trade fair for property and investment will highlight and discuss trends and developments in office real estate. Advances in technology and the ever-changing needs of users do not spare office properties.

The transformation of office property — the office of today

Everyone has an image in mind when it comes to the word “office,” with a desk being its dominant element. However, that is merely the lowest common denominator the various types of offices and workspaces can be reduced to. For a long time, individual cellular offices, occupied by one to three people, and open-plan offices, with numerous workstations spread across a large area, were the prevailing models. Distinct differentiation can now be observed here, primarily characterized by the desire and need for more flexibility in the organization of work. Nowadays, shared offices, where teams collaborate closely, and private offices, where individuals can retreat for confidential discussions or tasks that require high levels of concentration, are combined. There are also combinations of cellular and open-plan offices, where the “cells” surround a communal space equipped with meeting facilities, service amenities and kitchenettes. Other variations include open office landscapes (open space) and multi-space offices. In open space landscapes, different work options and communication zones are combined, allowing employees to choose the most suitable environment for their respective tasks. In multi-space offices, larger shared offices are typically combined with a smaller number of individual or multiple-person offices. And there is another significant change:

In the past, every employee had an assigned workstation, whereas now non-territorial workspaces predominate. This means that employees have to find an available desk and work there. This allows employers to have fewer workstations, reducing the number of unoccupied spaces when employees are on vacation, business trips or are working from home.

Offices are also changing due to the increased demands of the younger generations for social and creative opportunities, as well as recreational and sports areas. In an era where skilled workers are scarce, employers are compelled to adapt to these evolving expectations.

The market for office properties

The market for office real estate is as diverse as the forms of offices themselves. It ranges from modern “state-of-the-art” new buildings in prime locations to more conventional structures situated on the outskirts of cities or in small to medium-sized towns. It can also include renovated older buildings or repurposed properties transformed into office spaces. Additionally, combinations of office areas with publicly accessible spaces like retail, dining or other amenities are possible. Whereas in the past the user was often also the owner of the office building, this connection has since been severed in many cases, making office real estate increasingly appealing as investment asset. This shift has granted occupants greater flexibility in adjusting their required space, allowing for expansions or reductions as needed. Consequently, investments in office real estate have long held an uncontested position at the forefront of commercial real estate transactions.

Uncertainties dampen investments in office real estate

That, however, changed in 2023. According to JLL, only EUR 5.3 billion flowed into this asset class last year – marking an 81% decrease compared to the previous year, which already saw a significant decline from previous years with EUR 22.3 billion. As a result, the share of office properties in the total transaction volume of the German commercial real estate market dropped to just under 17%, sliding behind logistics, residential, and retail properties to fourth place.

This downturn has numerous causes. One is the sluggish German economy; another, and one likely to weigh more heavily in investment decisions, is not only the increase in financing costs but also in returns for alternative investments. Another reason is the differing price expectations of buyers and sellers, although both sides are increasingly coming closer together.

The reluctance of international investors in the office investment market is evident. Only about one-fifth of the transaction volume came from international investors, primarily from other European countries. But even German investors are showing caution. In 2023, only ten transactions with a volume of over EUR 100 million each took place. Transaction activity was livelier, albeit significantly declining, in the range between EUR 25 and EUR 100 million, while the number of transactions in the range between EUR 10 and EUR 25 million actually increased significantly compared to the previous year.

Rental market experiences a slowdown

The rental market is also faltering. Already in the first quarter of 2024, it became evident that the rental market was significantly losing momentum. The weak economic development reflected in a leasing volume that was around 20% lower than the previous year, reaching 2.1 million square meters in the five largest office locations in Germany.

However, there are significant differences between the A-locations: Berlin continues to lead in leasing performance, even though the decline here was at 21%. In second place is Munich, although with a leasing volume decrease of 38% compared to the previous year. Hamburg, in third place, benefited as the only city from four large leases (over 10,000 square meters), placing it only 12% below the long-term average. There are also significant differences in vacancy rates. In total, 6 million square meters of office space are available at short notice – pushing the vacancy rate to an average of 6.3%. Here, too, Berlin is in the lead with a vacancy rate of 4.1%. Hamburg and Cologne report similar rates. In contrast, Munich saw the strongest increase in vacancy – from 4.8% at the end of 2022 to 6.3% at the end of December 2023. Above-average vacancies are observed in Frankfurt with 9.5% and Düsseldorf with 9.4%. While prime rents have continued to rise in all five office locations, a differentiated picture emerges with average rents: while Düsseldorf (+4.8%) and Berlin (+0.8%) also saw an increase in average rent, Munich (-0.5%), Hamburg (-4.3%), and Frankfurt (-5.4%) experienced a decline.

The future of office real estate

To a certain extent, the market for office property is an indicator of macroeconomic development. Currently, the outlook for Germany is not overly optimistic. According to the latest economic forecast from the five leading economic institutes in Germany from the end of March 2024, growth of only 0.1% is expected for this year, and 1.4% for 2025. This sentiment is reflected in the expectations of businesses regarding their future performance and, importantly, their willingness to expand not only their operations but also their physical office space. On the contrary: the need for office space is rather being reassessed. The proportion of people working from home has increased due to the impacts of the COVID-19 pandemic. As a result, companies need to allocate less space for their employees.

A trend that has been gaining momentum for years is the rise of flexible office solutions. Especially for those in need of additional space on a short-term or foreseeable temporary basis, opting for such a solution has become preferable over committing to long-term lease agreements. Flex offices are also frequently chosen by small and medium-sized companies that may not necessarily wish or have the means to afford their own dedicated service areas and facilities. This trend will continue, because particularly digital solutions are also increasingly opening up opportunities for flexible arrangements.

Economic uncertainties and significantly increased financing and construction costs are causing project developers to proceed with much more caution. While 1.33 million square meters of new office space were completed last year – the highest figure since 2019 – these projects originated from before the crisis. Already in the last quarter of 2023, the completion volume was one-fifth lower than in the same quarter of the previous year. According to CBRE, currently, a total of 4.6 million square meters of office space are still in the planning or construction phase until the end of 2026.

It is important to note that the future of office property depends on various factors (including digitalization and different working models) and there may be regional variations. A comprehensive understanding of market dynamics and a careful analysis of specific locations and demand factors are essential for investment decisions.

What makes an office property attractive?

For a long time, the mantra for an office property has been “location, location, location,” which still holds true. Established office locations in the top five or top eight cities in Germany continue to command the highest prices and rents. However, it is no longer just about the location. It is becoming increasingly clear that buildings should have a Green Building certification to be attractive to investors and tenants. In 2022, around 46 % of the total investment volume in office properties was accounted for by certified buildings—compared to 34 % in 2020 and 46,2 % in 2022. This is likely related to the ESG taxonomy and the fact that, since January 1, 2023, Germany passed a carbon tax on commercial uses as well. Another factor is the EU’s plan to require energy-inefficient buildings to be upgraded to a higher level of efficiency.

But energy-efficient, certified buildings are often a “must” for occupiers, too, as larger companies in particular are also subject to ESG requirements. According to CBRE’s analysis, office properties with a Green Building certification in Europe achieve an average of 6 % higher rents, and the average vacancy rate is approximately 2 % lower. The competitive advantage over non-certified buildings lies in lower operating costs and the enhanced reputation the tenant gains.

The requirements for office properties are highly individual and can vary. They particularly relate to factors such as location, space configuration, infrastructure, flexibility, sustainability and security.

Office properties: trends and challenges

The further economic development poses a challenge for the office property market. In addition, the increased adoption of remote work, whether from home or elsewhere, at least does not amplify the space requirements. Moreover, employees’ expectations of their work environment are also evolving. Office buildings located on the outskirts of the city, lacking any surrounding amenities and without convenient public transportation access, are considered a deal-breaker, particularly among younger individuals. The “traditional” office concept is also becoming outdated. There is a growing demand for diverse types of collaborative spaces, as well as an increasing emphasis on sports and recreational facilities. While until recently parking spaces were indispensable for office properties, today it is electric vehicle charging stations, bicycle parking, along with shower and changing facilities.

Increasing demand for flexibility

Gone are the days when large companies would sign long-term lease agreements. Contract terms are becoming shorter as companies seek to respond flexibly to changing circumstances. Similarly, employees prefer flexible work models. Consequently, the number of flexible office solutions is on the rise, with operators leasing spaces and offering not just workstations but also a suitable environment and services for different tenants. Although prices for individual office spaces in flex offices are 10 % to 15 % higher than in the traditional office market, this particular market is experiencing significant growth and dynamism.

Adapting office stock to changing requirements

A topic that is currently being widely discussed in the residential sector equally applies to older office buildings: adapting to higher sustainability standards. This non-solely energy-related refurbishment is essential for maintaining attractiveness and preserving the respective property value. Particularly in terms of sustainability and considering the “embodied energy” within a building, demolition and new construction are often not the best solution. Given the possibility that not all spaces are needed anymore, it is also conceivable to repurpose these buildings, i.e., convert them into residential units. Determining the best potentials to realize and achieve a long-term increase in value is a task currently facing many asset managers.

What does EXPO REAL have to offer in the office property segment?

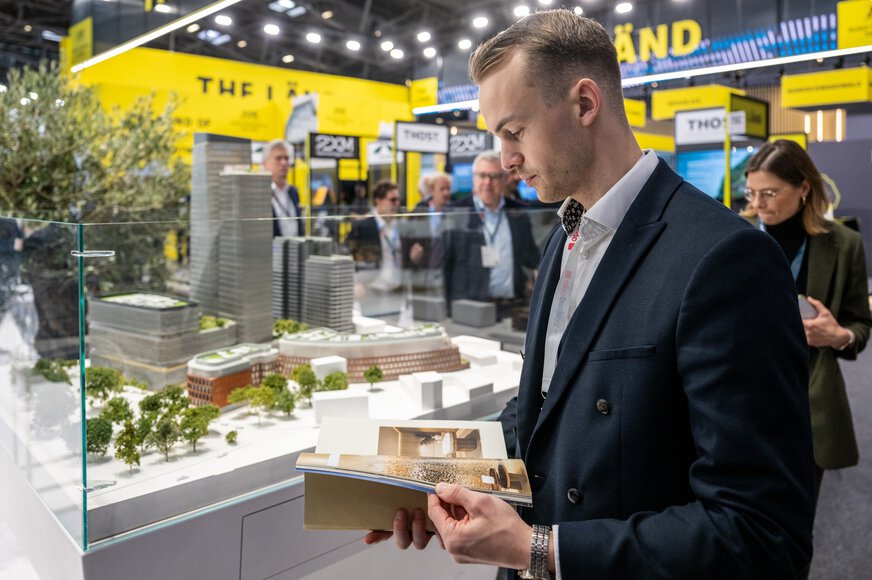

Exhibtiors dealing with office real estate form the largest group at the international trade fair for property and investment. The spectrum ranges from planners and architects, project developers, project managers and building technicians to financiers and investors, consultants and brokers, and facility and property managers responsible for smooth operations. All major players in the office property market are represented at EXPO REAL in Munich, as are the locations where office properties exist or are being developed.

Topics that move the industry

Accordingly, the industry’s pressing topics are also featured at EXPO REAL’s varied conference program. Last year, the question “Back to office—why should we still go to the office?” was on the agenda, along with the overarching topic of the impact of new work models on office space requirements in general and how office property owners are dealing with it. Experts discussed tenants’ expectations of office real estate. And last but not least, the topic of ESG took center stage, gaining significance for all participants in the office real estate market.