Logistics properties: trends and challenges

For a long time, logistics real estate had not attracted much attention on the real estate and property investment markets. This has changed significantly in recent years. Today, the demand for these commercial properties is higher than ever. In response to this development, EXPO REAL also focuses on logistics properties in its conference program. Here, experts from the logistics sector will discuss trends and developments in the field of logistics real estate and address the requirements to be met by these commercial properties. In addition, numerous exhibitors from logistics real estate sector are represented at EXPO REAL.

Logistics properties—one term for different types of buildings

Logistics properties are often considered to be the equivalent of a large warehouse. In fact, warehouses only make up a portion of this kind of real estate. Logistics property is mostly used to supply manufacturing companies with raw materials or to store finished goods. Usually, these warehousing facilities are complemented by assembly activities and similar processes. That is why the term “warehouse” is assigned to the “(light) industrial” sector.

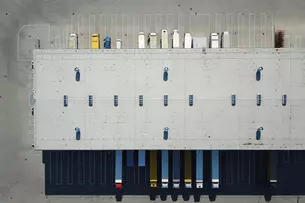

The most common types of logistics real estate are probably transshipment real estate and distribution centers. Transshipment properties, also known as cross docks, are typically used to transfer incoming goods from long-distance transport to local transport. The goods are thus in the transshipment warehouses for a short time, are repacked and then delivered. These halls have a low height and depth but are equipped with a high number of gates to keep the distances as short as possible for goods handling.

Distribution centers, also termed shipping centers, combine the function of a warehouse with the distribution of goods according to orders and may be responsible for regional and national distribution. Usually, such halls are higher and deeper and have more gates than a basic warehouse.

Lately, there has been much talk of last mile logistics. The last mile, i.e., the last part of the transport route before delivery to the customer, often is the most expensive part of the transport. Hence, solutions are being sought to bring logistics facilities closer to where many customers seek to be supplied. However, land is scarce and expensive, especially in and near cities. Consequently, corresponding real estate is still rare.

In addition to the types of logistics properties mentioned above, there are those with special requirements, such as cold storage or hazardous goods warehouses. These special logistics properties are subject to special construction and legal requirements, which is why they are usually only built according to the client’s requirements (built to suit).

From Cinderella to investor’s darling: the rise of logistics real estate

Only ten years ago, investments in logistics real estate ranked well behind office and retail properties: in Germany, they accounted for 6.6 % (€1.65 billion) of the total commercial real estate transaction volume. Today, investments in logistics real estate are in second place. According to CBRE, this asset class accounted for around 24 % (€6,95 billion) of the total transaction volume in the German commercial real estate market. While investments in industrial and logistics properties also saw a decline of 34% compared to the previous year, during the same period, the total transaction volume in the commercial real estate market decreased by 57 %.

The most active buyer group were open-ended real estate funds and special funds (€1.79 billion), closely followed by asset and fund managers (€1.74 billion). Project developers (€1.2 billion) rank third, who were also the most active sellers.

The currently higher financing costs have further reduced pressure on yields. Thus, net initial yields - depending on location and position - ranged between 4.1 % and 5.7 % at the end of 2023. In 2022, they were still in the range of 3.6 % to 5.3 %.

Why is logistics property gaining in importance?

Reasons for the upswing of logistics real estate from Cinderella to Investor's Darling and the high demand for logistics space are:

- high level of division of labor

- reduced warehousing by manufacturing companies - keyword: just-in-time delivery

- globalization and the associated worldwide networking of the economy

- increasing online trade

Logistics properties of the future: How will the industry develop?

Although last year, due to economic uncertainties, leasing turnover decreased by just over a quarter to 6.3 million square meters (2022: 8.5 million square meters), the demand for space remains high. And not only in Germany but also across Europe, the supply of logistics space is decreasing. According to a survey by Loginvest in 2023, the new construction volume in Germany has decreased to around 3.8 million square meters - this is 27 % (approximately 1.4 million square meters) less than what was completed in 2022. It is primarily the rising construction costs, challenging financing conditions, and the ongoing shortage of suitable land parcels that are slowing down new construction.

In line with the increasing scarcity of supply, both prime and average rents increased by 9 % and 11 % respectively in 2023.

Logistics properties—trends and challenges

Climate neutrality and environmental sustainability is a predominant concern for all types of real estate, which means logistics property is no exception. This is true for the construction of these commercial properties as well as for their operation and possible deconstruction. Furthermore, logistics properties are no longer simply warehouses, but “smart” buildings with digitally controlled energy consumption, lighting, water and heating. Yet this is not the only reason why logistics areas of all kinds need a digital infrastructure—the advancing automation and increasing digitalization of logistics also require a connection to a “broad data highway.”

Where is the market for logistics properties headed?

Something that concerns the entire logistics industry is the last mile, the majority of which is slightly longer than one mile. It is not only companies, restaurants, supermarkets and retailers that want to be supplied, but also private households that have become used to the options of ordering online. E-commerce has grown rapidly in recent years, and today’s consumers expect their orders to be delivered as promptly as possible. Since most consumers live in cities and metropolitan areas, distribution centers are particularly needed here, as close as possible to potential customers. Another factor is that traffic is more than dense, especially in cities and urban regions, and the large number of delivery vehicles adds to the traffic chaos. For city logistics, one solution would be to create additional transshipment points that could be used to deliver to city districts or neighborhoods—perhaps even with a cargo bike instead of a truck. However, land is scarce and expensive in cities and metropolitan regions. There may be the occasional opportunity, for example, to convert old department stores or factory buildings that are no longer in use into such small distribution centers. So far, however, this has been the exception rather than the rule.

In addition, the population often has little acceptance of logistics facilities in the vicinity of residential areas—for fear of even more traffic. It remains to be seen whether the switch to electric or hydrogen vehicles will increase this acceptance. This transformation, though, will require the installation of charging stations or hydrogen fueling stations at many logistics facilities—a development that may come sooner than expected.

What does EXPO REAL have to offer in the logistics real estate segment?

Being a segment of the commercial real estate market, logistics properties have always been a part of the international trade fair for property and investment. Along with its growing importance as an asset class, the topic of logistics has also become more prevalent here.

What exhibitors will be found at EXPO REAL in the logistics property sector?

EXPO REAL will feature well-known national and international project developers specializing in logistics real estate. The fair will also feature investors who invest in logistics real estate and locations that are open for logistics settlements.

One central element for logistics real estate at EXPO REAL is the joint pavilion LogRealCampus, which includes the Logistics Real Estate Initiative (Logix). Renowned personalities and companies in the industry have joined forces in this initiative and are committed to dialog, research and an improved image of logistics properties among the general public. The Logix Initiative’s research and publications are dedicated to a variety of relevant and current industry topics, such as municipal dialog and climate protection. Here you can find the EXPO REAL 2024 exhibitor directory.

Topics that move the industry

Messe München collaborates closely with Logix, also and especially in setting up the conference program. For example, in 2022 under the heading “Let’s Talk Logistics,” experts discussed “Logistics property—what concepts offer the best solutions?” and “Logistics property as an asset class: How sustainable are returns in an environment of rising interest rates?” And the REAL ESTATE INNOVATION FORUM explored the question “The digitalization of logistics property: Utopia or reality?”

Since 2013, the Logix Award has been presented to logistics properties in Germany that meet the requirements of users and investors to a high degree. The Logix Award ceremony will take place again this year at EXPO REAL.

Impressions EXPO REAL 2023